THANK YOU FOR SUBSCRIBING

The Future is Closer than You Think: Technology Trends that will Impact the Financial Services Sector in 2019

Albert Tay, Director, Financial Services Industry, Asia Pacific and Advancing Market at OpenText

Albert Tay, Director, Financial Services Industry, Asia Pacific and Advancing Market at OpenText

With continued growth in the number of global customers in banking, insurance, wealth management and fintech, the landscape of the financial services sector continues to evolve due to the progression of technology and customer expectations.

There are several technology trends that are surfacing within the sector and it is important for financial institutions to remain relevant to ensure their success. As we start a new calendar year, let’s delve into some of the trends to look out for in Asia Pacific in 2019.

Focus on investing for productivity resulting from global instability

Financial institutions will be focused on reducing their exposure to the significant macro-risks impacting the global economy. In its October 2018 World Economic Outlook, the IMF revised global growth estimate down, stating that “downside risks to global growth have risen in the past six months and the potential for upside surprises has receded.”Developed economies in Asia face a risk of political instability from disputes regarding the South China Sea, the ongoing maritime tension between Singapore and Malaysia, or even the deteriorating US-China relations that would affect countries globally, including Singapore.

Against this backdrop, 2019 will be the year that financial service firms focus technology investment on material cost-savings and productivity gains through the use of AI and automation for key parts of operations.

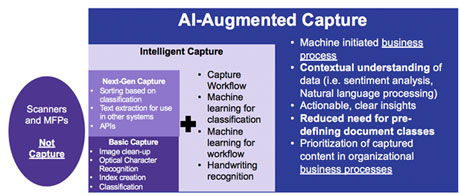

For example, we have seen a growing interest in AI-Augmented capture in the financial services sector. Combining digital capture tools with AI can limit the administrative burden of document collection and categorization, while extending the productivity gains of digitization deeper into the business. Automatically assigning meta-data, routing routine workflows, or error detection are simple functions added greater levels of compliance by identifying sensitive information enabling the system to apply the appropriate controls that can bring significant value.

Rise of new digital competitors

Traditional financial services companies face competition from an expanded set of competitors.

Digital players are starting to capture market share in payments (see Kakao in South Korea) or wealth management while digital-only banks (such as WeBankin ChinaandJibun Bank in Japan) are staring to capture more attention.

DBS, Singapore’s’s largest bank, cites efforts to help customers transition to digital services as a key profit driver. The bank earns more than twice as much revenue from each digital customer compared to a traditional customer.

Even the Singapore Exchange (SGX) and The Monetary Authority of Singapore (MAS) now leverage blockchain technology to settle tokenised assets to simplify post-trade processes.

New competition will be a key driver for digital transformation in the financial sector for 2019. Investments in digital-first, high-margin services are essential to compete with agile new fintech disruptors.

Increasing competition is shifting focus to customer centricity

Facing increasing competition, financial services are placing a renewed focus on customer experience (CX).

The financial services sector must embrace compelling, digital-first experiences as they transition their businesses services to serve younger customers

Accenture suggests that personalized customer experience could bring $2.95 trillion in value for the retail sector alone. At the same time, poor customer experience is getting very costly. According to Forbes, a drop of just one point on its CX score can cost a large, multichannel bank up to $124 million.

Customers demanding great service is nothing new, but for 2019, these experiences will be increasingly digital, personalized and contextual. Advanced analytics and AI can help create fulsome profiles of customers and deliver personalized and contextual messaging. Simple applications, such as recognizing customers by phone number when they call in for services or helping provide services through mobile apps are now the table-stakes.

AI-augmented Capture transforms traditional capture and delivers utmost operational efficiency

In 2019, industry leaders will expand to link customer financial and personal milestones to customized marketing efforts. Marketing materials that represent minority language preferences, custom graphics or video marketing will help ensure that customers see themselves reflected in the materials from their bank, wealth manager or insurance provider.

Digital-first experiences address the needs of millennial customers

The financial services sector must embrace compelling, digital-first experiences as they transition their businesses services to serve younger customers.In Singapore, more than 90% of customers do their banking online or via smartphone.

As noted above, financial institutions are loosing ground to digital-first entrats in the sector, especially among millennials.If they are losing ground with millennials, how can they prepare to service even more digitally-savvy Generation Z consumers?

Younger customers are ready to adopt new digital services and are comfortable with a digital-first financial services experience.

Financial institutions are therefore transforming their services to digitize new processes. Paying bills and transferring funds is now commonplace, but customers are expecting to be able to perform more complex transactions online – from opening accounts, to getting basic investment guidance.

Serious investments in information security, governance, and data privacy

Finally, The Financial Services sector must continue to lead on issues of cybersecurity and data privacy. The sector is facing emerging new regulations and highly-sophisticated new attack vectors.

The new GDPR regulationns introduced in in Europe last year are likely to create momentum for similar moves globally.

Similarly, organizations like banks are now tasked with more types of investigations than ever before; HR issues, compliance violations, regulatory inquiries, IP theft and more. To solve these issues, financial institutions may need to look deeper in to an employee’s activity discreetly and even remotely without sacrificing employee productivity.

2018 also saw serious data breaches and an erosion of consumer trust. Marriot hotels announced a data breach affecting an estimated 500 million customer records. Facebook faces an ongoing barrage of criticism over its handling of personal information. In the Financial sector, we have witnessed major comprises of the Swift network by North Korean hackers.

Recent data from Microsoft points to the high cost of these attacks. They found that large businesses could incur economic losses of $30 million USD from cybersecurity breaches.

Data shows that banks are already the highest spenders on security and this is unlikely to change. According to Kapersky Labs, banks spend around three times what non-financial organizations do on cybersecurity. As customer and regulator expectations around cybersecurity continue to increase, we expect further investments.

Weekly Brief

I agree We use cookies on this website to enhance your user experience. By clicking any link on this page you are giving your consent for us to set cookies. More info

Read Also

Empowering Educators with Faith, Excellence and Purpose

Leading with AI: From Ethics to Enterprise Impact

Done Today Beats Perfect Tomorrow: The New IT Advantage

The Shift from Cybersecurity to Product Security: A Business Imperative

Advancing Retail through E-Commerce, Cloud and Cybersecurity

Transforming Risk Management into Strategic Business Advantage

Designing Future-Ready, People-Centered Workplaces

Shaping Customer Experience Through Smarter Logistics